To Sell or Not to Sell: Navigating the New Tax Increase on Capital Gains

The federal budget’s proposed increase in the capital gains inclusion rate has some asking: “Should I trigger my gains now?”

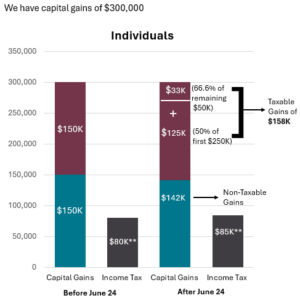

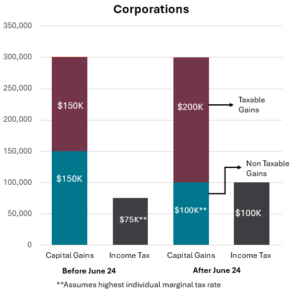

Some of the loudest noise emanating from the series of budget announcements is how capital gains will be taxed after June 24, 2024. Prior to this date, when you have a gain on the sale of an asset, 50% of the growth in value since you bought it is taxable income. It doesn’t matter if we’re talking about your operating business, a stock portfolio, rental property, a cottage (assuming it’s your second home), art collection or any other asset. It also doesn’t matter if the owner is a person, trust or corporation.

After June 24, you will be paying tax on 66.6% of the growth on the sale of those same assets. The one exception in these new rules applies to the first $250,000 of gains realized by an individual in any one calendar year. Corporations and trusts were not afforded this exception.

Let’s Look at the Difference

Assume I own a stock portfolio (outside an RRSP or TFSA) and I originally paid $200,000 for it. If I sell it for $500,000:

If an individual has even more gains than in our example, the increase in tax gets worse, because they have already used up their $250,000 exception.

So we ask: “Should I sell some of my assets prior to June 24?” – This would ensure I am paying tax on my gains at a lower rate.

The answer is: “All factors of your individual situation should be examined before making this determination”. We know that’s not helpful, so we offer the following general conclusions:

- Keep in mind the exception on the first $250k for individuals – as long as you are likely to stay under $250k in gains every year, there is no need to act now.

- If it is likely that you were going to sell the investments anyway in the next year or two it probably makes sense to trigger the gain now. Even though you are getting the tax bill early, it will be less than if you sell it later.

- If you were not planning on selling the asset(s), the answer is trickier for corporations and also for individuals likely to go over the $250k annual exception. Do you pay the tax now because it’s lower, and then re-invest back into the same investment? Or do you avoid triggering the tax in the hope that, by staying invested with the larger amount, the future growth will be more than the early tax savings?

Consider these General Calculations

- For corporations and individuals, you are better off NOT triggering the gain, if you hold the investments for another 5-6 years.* Our calculations have determined that the growth on your larger investment balance will overcome the higher inclusion rate.

- If you have capital losses carried forward from previous years, those will be adjusted upward if you are selling assets after June 24 to match the higher capital gain inclusion. Take this into account before concluding that you need to trigger the gains.

*Assuming a continued rate of growth for the capital of 6% per year

There is no doubt that many people and their corporations will eventually pay more tax because of this budget announcement.

We believe it will be far more than the 0.1% of Canadians estimated in the budget document. For long-term investors, there is no benefit from acting prior to the effective date of the change. For those planning to sell in the near future, it might be worth moving the date up to June 23, 2024.

If you want help or a discussion about the particulars of your own situation, including the impact on more illiquid assets like a family cottage, rental property or a business, please don’t hesitate to contact us.

Join our mailing list

Sign up to receive tips and information on adding value to your business.