overview

Personal and business financial solutions

Founded in 1981, CAPCORP has become one of Canada’s leading independent financial services companies. Our clients range from large national organizations to the individual investor.

Our success is derived from a commitment to developing and maintaining quality, long-standing client relationships. Our independence allows clients to access products offered by most insurance companies, trust companies, and other financial institutions in Canada. Our longevity attests to our reputation as a solution-driven company offering expert advice to business owners across the country.

Employing leading experts in the fields of retirement planning, estate planning, succession planning, charitable bequests, and insurance brokering, CAPCORP provides our clients with innovative, tailor-made solutions that meet of the demands of the ever evolving financial world.

OUR TEAM

Working for you

CAPCORP believes in a team-based approach to the way we work and how we support our clients.

Our Advisor Team

Working together, combining high level knowledge and experience to provide you with the right advice.

Andrew Noseworthy, B.Comm, CFP, CHS

PresidentAndrew Noseworthy, B.Comm, CFP, CHS

PresidentAndy joined CAPCORP in 1993 after graduating from McGill University with a bachelor of commerce and earned his Certified Financial Planner designation in 2004. Businesses and Individuals looking to enhance and preserve their net worth rely on Andy’s expertise in the areas of tax planning, estate planning and wealth management. As CEO of CAPCORP, a business owner, and a proud father to Emily, Jack and Amy, he is all too aware of the challenges and added complexity that comes from owning and running a business, managing a busy team of employees while still remaining dedicated to family. Andy’s passion for helping business owners is fueled by a true appreciation of the entrepreneurial spirit:

“I continue to be fascinated and impressed by all of the ways our clients have figured out a way to make a buck! There is nothing that motivates me more than adding value to the life of an entrepreneur that is working every minute of every day to build a great business.”

Business owners need advice that crosses tax, legal, Human Resources, insurance and financial in both their corporate and personal lives. Andy prides himself on being that first contact. His clients have come to rely on the intelligent and straightforward advice that comes not only from his training and experience, but from the collective experience of the business owner clientele he is served for over 25 years. He delivers wealth and planning solutions that are at the forefront of today’s thinking, while making your life simpler, not more complex.

Mike Hamilton

Financial AdvisorMike Hamilton

Financial AdvisorMike Hamilton has been a financial advisor and Partner at CAPCORP since 2003.

Mike’s niche is helping small business owners and the medical professional community protect their families and their businesses with insurance solutions. He is passionate about Critical Illness insurance and travels on a National basis speaking on the topic..

In 2003, Mike was initially hired by GWL as a Specialist. He switched gears and joined London Life. A few months later, he joined the family business at Capcorp and has never looked back.

When Mike is not helping his client’s achieve their financial goals and dreams, he enjoys coaching baseball and basketball, doing Lego mosaics and playing board games with his sons London & Easton and his wife Erin.

Graham Young, B.Comm, CFP

Director, Employee BenefitsGraham Young, B.Comm, CFP

Director, Employee BenefitsGraham Young joined Capcorp Financial in 2014, managing and directing the employee benefits practice. With a forward-looking approach to supporting clients, Graham works with the team to ensure advisors continuously monitor industry programs and trends and regularly consults in benefits and HR technology. As a Certified Financial Planner (CFP), Graham is also uniquely positioned to provide resources and advice to individuals and organizations. Graham currently represents Capcorp as the Chair of the board of Benefits Alliance, a not-for-profit in the benefits industry that promotes education and advocacy on behalf of benefits advisors and their clients.

Originally from the East Coast of Canada, Graham can often be found sailing on the Ottawa River and spends many of his holidays exploring new waters with his family. Graham is also actively involved in the community and can be seen regularly behind the bench for his son’s hockey team.

Graham has a Bachelor of Commerce Degree from Saint Mary’s University in Halifax and has been in the insurance and investment industry for nearly 20 years.

Matthew Chiang, Hon.B.Sc, CFP

Certified Financial PlannerMatthew Chiang, Hon.B.Sc, CFP

Certified Financial PlannerMatthew joined CAPCORP in 2009 after working with one of Canada’s largest financial planning institutions. He is a graduate of the University of Waterloo with a Bachelor of Science (Honours) and earned his Certified Financial Planner (CFP) designation in 2012.

Matthew actively advises a large number of CAPCORP clients comprising a significant portion of the wealth and risk management offering at CAPCORP. He specializes in formulating transparent and easy-to implement financial plans that are robust and fully protected.

“I am a firm believer that everyone should have clarity and control over their financial lives. My mission is to ensure that all my clients understand why they are saving and investing in the first place.”

Local businesses also rely on Matthew’s expertise in the area of employee group health benefits and retirement savings. His forward thinking mentality and cost containment strategies ensure that businesses can maintain an affordable and effective benefits plan in place for their hard working employees.

While Matthew is always available to his clients, he does find time outside of work to enjoy the outdoors with his wife Jessica. On the odd occasion, you may even find him on the golf course working on his game.

Brian Hay, Hon.B.Sc., PFP

Financial AdvisorBrian Hay, Hon.B.Sc., PFP

Financial AdvisorStarting in the industry in 2000, Brian joined Capcorp in 2012 and brought his passion and knowledge of investing to the team. His desire to help clients and his extensive investment experience have allowed him to develop strong and lasting relationships with his clients. Brian is known for building the right profile to guide his clients towards retirement and helping them achieve their financial goals.

Brian also supports the Capcorp team by maintaining and refining the group RRSP portfolios. As the Investment Specialist, he develops reports and provides analysis and advice on changes within the different investment lines, including securities and asset allocation.

Brian has completed the Canadian Securities Course, the Professional Financial Planning Course, and is both mutual fund and life insurance licensed. He holds an Honours Science degree from the University of Waterloo. When not traveling, Brian enjoys the cottage, spending time outdoors, and working on his next black belt with martial arts training. Brian is also the founder of Fill the Foyer, an annual event at CAPCORP which began in 2012 and supports the Ottawa Food Bank with food and cash donations.

Cory Wilson

Financial AdvisorCory Wilson

Financial AdvisorCory earned his economics degree from Carleton University in 2018 and is currently on track to earn his CFP (Certified Financial Planner) designation. Cory launched his financial planning career at London Life – Freedom 55 Financial in 2020 before joining Capcorp in April of 2021, where he works very closely with individuals and business owners to help them achieve financial success. In his short career, individuals and businesses have trusted Cory when it comes to wealth management, retirement planning, estate planning, and employee benefits.

Cory makes it his priority to provide his clients a high level of customer service, knowledge and understanding of the financial landscape. A well thought out plan gives people confidence and peace of mind that they are moving in the right direction and will ultimately accomplish their goals. Outside of work, Cory maintains an active lifestyle through sport and gives back to his former minor hockey association as a Coach.

Zacharie Leblanc

Financial AdvisorZacharie Leblanc

Financial AdvisorZacharie was top of his class at La Cite Collegiale where he graduated with a diploma in Business Administration, with a focus in Finance. He went on to complete his Bachelor’s in Finance from Telfer School of Business at the University of Ottawa. In working towards his Certified Financial Planner (CFP) designation, Zacharie has successfully completed the Canadian Securities Course (CSC) and Life Licence Qualification Program (LLQP).

Zacharie has held multiple financial positions prior to joining CAPCORP, most recently working as a Financial Analyst with the CRA. Along with his French language skills, Zacharie brings with him extensive knowledge in financial analysis and a strong desire to work with our clients in building long-term relationships and provide the education needed to meet your financial goals.

Zacharie spends his time away from the office playing golf and hockey, sports that have taught him important values, such as integrity, reliability, and accountability. He also enjoys spending time with his family and friends at their cottage in Quebec.

Hanna Jackson

Financial AdvisorHanna Jackson

Financial AdvisorHanna Jackson graduated with distinction from Carleton University in 2022, earning a Bachelor of Commerce (Honours) with a major in Finance. She is currently pursuing her Chartered Financial Analyst (CFA) designation and has successfully completed the Canadian Securities Course (CSC) and Life Licence Qualification Program (LLQP).

Before joining CAPCORP, Hanna gained valuable experience as a Financial Analyst at Taggart Investments. Her approach to financial advising is centred on providing personalized, client-focused guidance that adapts to the ever-changing needs of her clients. Hanna is dedicated to building long-term relationships and empowering clients with the financial knowledge necessary to make informed and confident decisions. She understands the importance of not only growing wealth but also protecting it.

Outside of her professional life, Hanna has a rich background in competitive highland dance, which instilled discipline and perseverance in her. She enjoys spending quality time with her family and friends and finds relaxation in reading a good book.

Alex Sernoskie

Employee Benefits AnalystAlex Sernoskie

Employee Benefits AnalystAlex completed his BA in Economics, with Honours, at Ryerson University and his MA in Economics at Queen’s University. He first joined Capcorp Financial in 2014 as a summer intern at our Toronto office, Protect Financial, while finishing his studies at Ryerson University.

Alex is our go-to problem solver, he believes that there is a solution for every benefits situation. “Employee benefits can often be seen as a big, complicated thing and I work hard at turning complicated situations into something that is simple and makes sense for our clients.”

Alex is always eager to try new things and that brings him on a journey of having many different activities and hobbies on the go. His favourite activities include cheering on his favourite team Liverpool FC, participating in Jiu-Jitsu classes, both as a teacher and student, and spending quality time with his wife Amelia and their dogs.

Robert Houle, BA (Hons), MPA, CFP, CLU, CH.F.C., RPA

Robert Houle, BA (Hons), MPA, CFP, CLU, CH.F.C., RPA

Since 1992, Robert Houle has been a principal of CAPCORP advising clients on the design and funding of employee benefits both group insurance and group retirement plans. Implementing innovative solutions has helped employers control costs while balancing risk with plan participants encouraging them to be better consumers. During his career as a benefits advisor, Robert has been active in the industry where he is a founding member and past chair of The Benefits Alliance Group Inc., Canada's Leading National Alliance of Independent Employee Benefits Advisors. The Benefits Alliance Group is comprised of 28 member firms with more than 175 associates administering over 6,000 group benefit plans with $1.15 billion of group insurance premium and 1,100 group retirement plans with over $2.5 billion in plan assets. In addition, Mr. Houle served as a Director of the Conference for Advanced Life Underwriting where he also chaired the national Employee Benefits Issue Group. Throughout his career, he has been a member in good standing of The Financial Advisors Association of Canada and Advocis.

Robert Houle was very active in politics serving in roles such as city councillor, campaign manager, executive assistant to a Member of Parliament and chief of staff to a federal cabinet minister. Also Mr. Houle spent 13 years on the board of directors of the Royal Ottawa Foundation for Mental Health. Robert has been married to Nora Valantin for 33 years and they have two adult daughters, Andrea and Stephanie who is married to Evan Johnson. He enjoys golf, snowmobiling and travelling.

Our Account Management Team

Knowledgeable and determined in their commitment to go above and beyond every day, providing clients with the highest level of service and support.

Operations

Every successful team has an exceptional support engine.

OUR COMMUNITY

Giving back

As a community-conscious enterprise, CAPCORP realizes strength in numbers can realise true change.

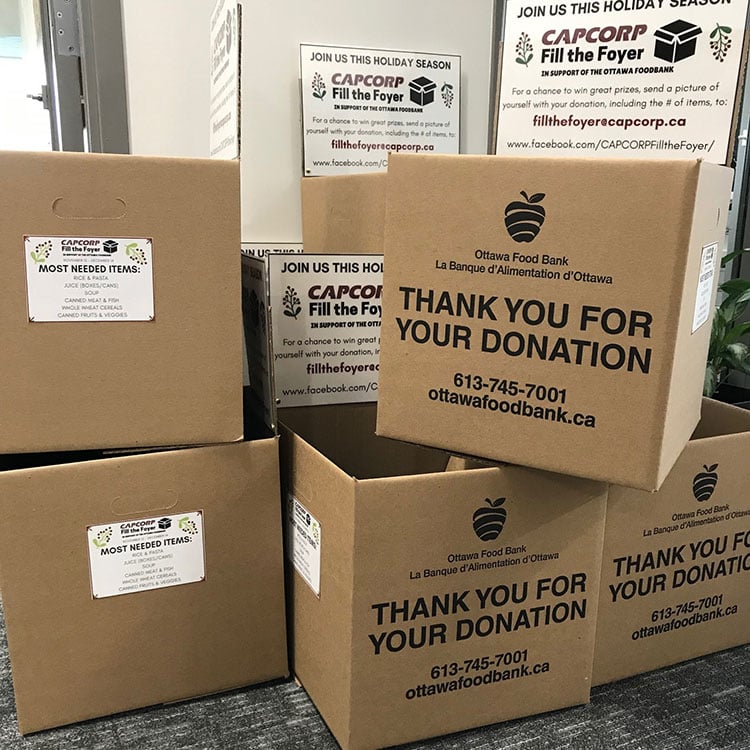

CAPCORP – Fill the Foyer 2018 Fundraising Campaign

Fill The Foyer

Fill the Foyer in support of The Ottawa Food Bank is an annual campaign that began in 2012. Since then, it has truly taken on a life of its own as it brings together Clients, Colleagues, neighbours and friends to give back to our community. At the start of the campaign our team delivers empty boxes to be left in the foyer or front entrance of participating Ottawa businesses. Some companies even host bake sales or BBQ’s to raise money, food and awareness for the Ottawa Food Bank. Along the way, pictures of our supporters and the stories of their efforts are updated on Facebook and social media. At the end of the 5 week campaign, we then collect all the boxes along with any monetary donations received.

CAPCORP then matches a $1 for every monetary donation and food item collected from all of the businesses. What means the most is to see how everyone gets involved and who then becomes a part of the Fill the Foyer family. It is a success year after year because of them!

Would your business be interested in participating?

Email us: fillthefoyer@capcorp.ca

Fill the Foyer Facebook page https://www.facebook.com/