THE REAL ESTATE FUND A Great Way to Diversify

A cornerstone of good portfolio management is proper diversification. In simple terms: don’t put all your eggs in one basket!

The Real Estate Fund owns 88 high-quality, income-producing Canadian properties valued at $3.8 billion. This real estate fund does not own individual residential real estate in the neighbourhoods we live in. It owns a diversified portfolio of commercial real estate in the retail, office, and multi-unit residential and industrial sectors. The combination of steady rental income and appreciation of the value of the buildings is what has generated its positive, stable returns over time.

Traditionally, the downside of real estate is its illiquid nature. With traditional real estate, buildings or properties need to be sold in order to cash out your investment. An advantage of the Real Estate Fund is that it offers daily liquidity – allowing investors to access their funds whenever required. However, during times of extreme uncertainty in the market, proper evaluation of real estate properties becomes inaccurate and difficult. This makes it difficult to properly determine the value of the investment for those seeking to withdraw funds. The Real Estate Fund does have the ability to suspend contributions, redemptions and transfers. Temporary suspensions are used to protect the long-term interests of all investors until markets normalize. This occurred in 2008 during the financial housing crisis and most recently in 2020 at the start of the Covid-19 pandemic. Each subsequent investment period after the suspension was lifted, the Real Estate Fund generated double-digit positive returns for investors

A Reliable Alternative Investment

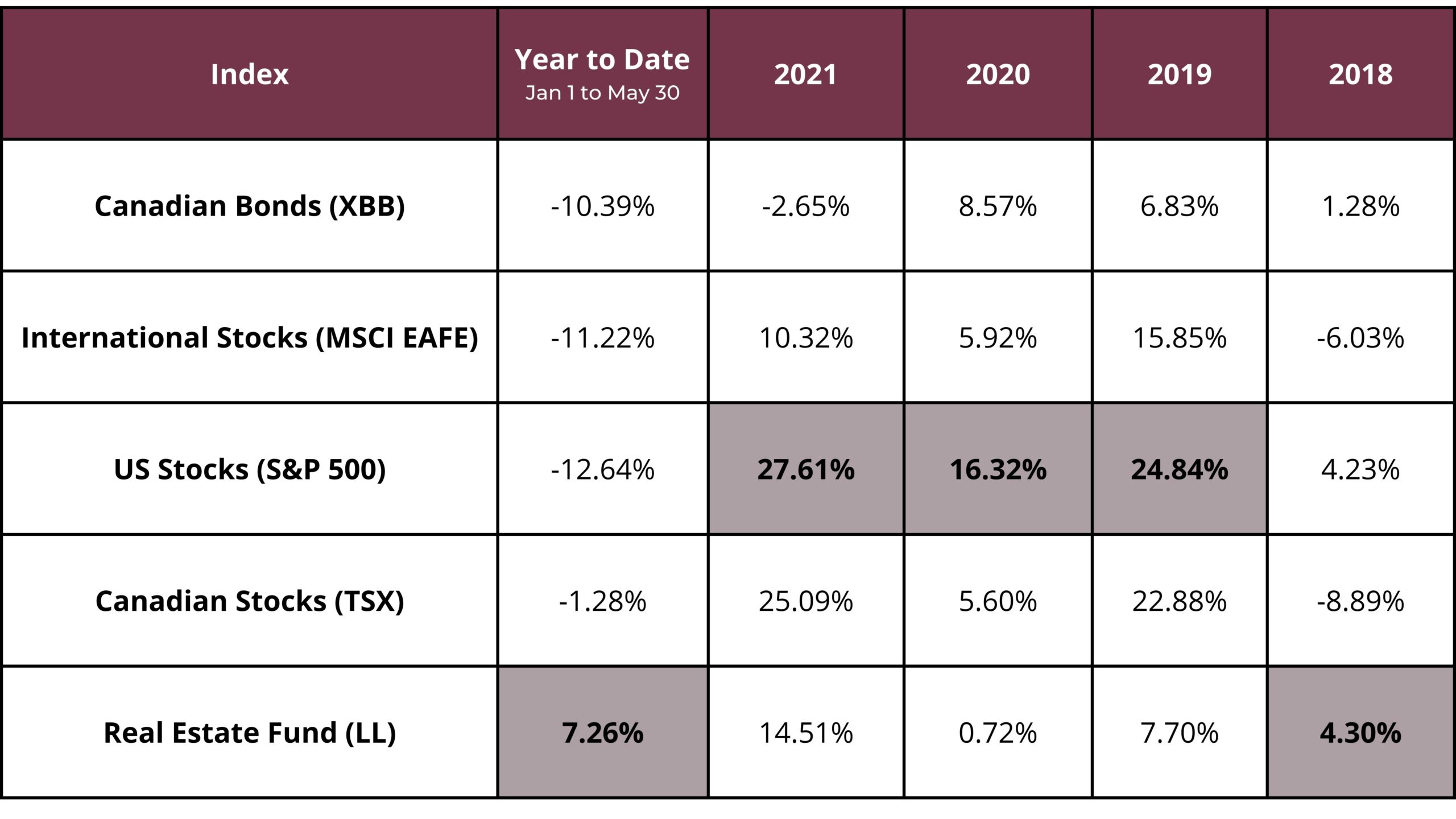

CAPCORP ensures that all the investments our clients own perform differently at varying times of the economic cycle. Adding another asset class like the Real Estate Fund means that when the stock markets experience extreme volatility, there is an alternative investment within your portfolio. The result of this diversification is a substantial reduction in the overall risk to your money and more consistent returns. The chart below shows the rate of return of the various components of an investment portfolio since 2018. The best-performing asset class has been highlighted in bold

Strong Rates of Return

Where Canadian, US and International stocks are normally expected to produce the highest rate of return over time, these high rates of return don’t come free; they can also produce some large losses. These negative returns have been our experience so far this year, driven by rising interest rates and a conflict that continues to persist in Ukraine.

The Real Estate Fund, however, remains positive. In fact, it is the only holding to be positive during ALL of the above time periods. When mixed with the diversification within the Blue Chip Equity portfolio, the combination provides much more consistent returns at a lower risk than the market.

Contact us to learn more. It’s times like these when stock markets are fluctuating, that it’s ideal to have the reliability provided by the Real Estate Fund.

Join our mailing list

Sign up to receive tips and information on adding value to your business.