How to Maximize Your Tax Deduction by Combining an FHSA and Home Buyers’ Plan (HBP)

Once an individual turns 18, they are eligible to open a First Home Savings Account (FHSA) and a Registered Retirement Savings Plan (RRSP).

If you are considering purchasing your first home, a savings strategy that is not yet widely known is to combine the First Home Savings Account (FHSA) and the Registered Retirement Savings Plan’s (RRSP) Home Buyers’ Plan (HBP) to maximize your tax deductions.

To fully understand how this process would unfold, let’s first establish the features of both plans.

First Home Savings Account (FHSA)

An FHSA is a registered savings plan that allows first-time home buyers to contribute up to $8,000 annually with a cumulative maximum limit of $40,000. It also allows for one year of contribution room to be carried forward into the next year. Contributions into the plan are tax-deductible, growth within the account is tax-free, and as long as the withdrawal is being made for eligible purposes, withdrawals from the account are also tax-free. There is no minimum holding period for contributions or transfers before they can be used for a qualifying withdrawal. This means you can deposit $8,000 into the account today, earn the tax deduction, and withdraw that money the next day, tax-free.

To withdraw from your FHSA tax-free, the following criteria must be met:

- Be considered a first-time home buyer for FHSA purposes, which means you do not own or jointly own your principal place of residence currently, or within the last four calendar years.

- Have a written agreement indicating that you will acquire, or complete construction, of your qualifying home before October 1 of the year following your withdrawal. You must intend to occupy the home as your principal residence within one year after buying or building it.

- Have not acquired the home more than 30 days prior to the withdrawal.

- Must be a Canadian resident from the time of the withdrawal until the acquisition of the home.

Home Buyers’ Plan

The second component of the strategy involves the RRSP’s Home Buyers’ Plan (HBP). Like the FHSA, contributions to an RRSP are tax-deductible and money grows tax-free. In contrast though, withdrawals are taxed as income. However, under the HBP, an individual may withdraw up to $35,000 tax-free from their RRSP to use towards the purchase of a home, provided the money is repaid into the RRSP over 15 years. To qualify, you must buy or build the home by October 1 of the year following the withdrawal. In contrast to the FHSA, funds contributed to your RRSP must sit in your account for at least 90 days before making an HBP withdrawal.

Doubling Your Tax Deduction

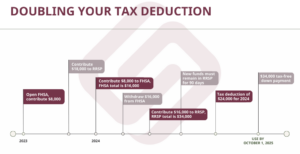

To maximize tax deductions using both plans, consider this example: In 2023, you contributed the maximum $8,000 to your FHSA and $18,000 to your RRSP. In 2024, you contribute an additional $8,000 to your FHSA, for a total of $16,000 in the account. This will give you an $8,000 tax deduction for 2024. Later in the year, you need to withdraw, not transfer, the money saved in your FHSA for a qualifying home purchase. Once you withdraw the $16,000 saved in your FHSA, you still have until the following year’s October 1st to acquire your new place of residence, so you don’t need to use the withdrawn money immediately. As such, you then contribute the $16,000 into your RRSP to obtain a second tax deduction. This contribution will remain in the RRSP account for 90 days, you can then withdraw it, as part of the HBP, along with the $18,000 contributed in 2023. This gives you a tax-free withdrawal of $34,000 to put towards your home and a total 2024 tax deduction of $24,000, even though you only contributed $8,000 of new funds in 2024. Note that the $34,000 withdrawn would need to be paid back into your RRSP over the subsequent 15 years. This approach can also work in reverse between the RRSP-HBP and FHSA.

If two spouses or partners are buying one property, both parties can use this approach to double the household savings yet again.

Contributing and withdrawing strategically using both the FHSA and the HBP allows first-time home buyers to maximize their tax deductions while also enhancing their home-buying potential. Combining these tools can lead to significant tax savings and provide a substantial financial boost toward purchasing your first home.

Connect with us today and let us help you!

Join our mailing list

Sign up to receive tips and information on adding value to your business.