Will your children be able to afford the Capital Gains Tax on the family cottage?

In Canada, your principal residence is excluded from any capital gains taxation upon its sale. Any subsequent properties you own, like the family cottage, will incur capital gains taxes upon sale or inheritance.

With this, one of the greatest financial challenges your children will face upon inheriting the family cottage is the capital gains tax liability. Will other inheritances cover this cost? Will they be able to personally afford it?

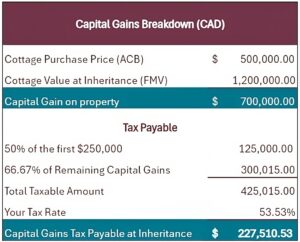

When a property appreciates over time, the difference between the original purchase price (ACB) and the market (FMV) value at the time of inheritance can trigger a sizeable capital gains tax.

Important Terms to Understand

- Adjusted Cost Base (ACB) – The purchase price of the property plus the amount of any ‘capital improvements’ made over the years

- Fair Market Value (FMV) – The value of the property if sold on the open market

- Capital Gain – The difference between your Adjusted Cost Base (ACB) and the Fair Market Value (FMV) of the property

The Canadian government has recently modified how this Capital Gains tax is calculated so this tax impact is now even greater. As of June of this year 50% of the first $250,000 in capital gains is taxed at your individual tax rate. For every dollar beyond $250,000, 66.6% (or 2/3) is taxable at your individual tax rate. We’ve provided an example breakdown in the chart below.

Whole Life Insurance as a Tax Strategy

One of the simplest strategies for dealing with the capital gains tax bill is the purchase of a Whole Life insurance policy. It will provide liquidity both during your lifetime and when it is needed most – on death, to pay the capital gains tax. The policies have an array of great features:

- A guaranteed level lifetime premium

- A growing investment value

- A growing, tax-free death benefit (to keep pace with the growth in value of your cottage!)

There are other solutions that are sometimes considered to solve this problem. Each of them has advantages but also cost, tax implications and complexity. Some of these alternatives might include:

- Gifting the cottage to your children in advance.

- Adding your children to the property title.

- Implementing an Estate Freeze.

Keep the family cottage in the family

By planning ahead, your children can seamlessly transition into property ownership without the immediate financial burden of a large tax bill. A Whole Life insurance policy offers one of the simplest and financially viable solutions. Connect with us today and let’s explore the best strategies to preserve your legacy for the next generation.

“the only thing you take with you when you’re gone is what you leave behind”

John Allston

Join our mailing list

Sign up to receive tips and information on adding value to your business.